Image credit: seia.org

Solar Photovoltaic Incentives

1. Federal Photovoltaic Incentives

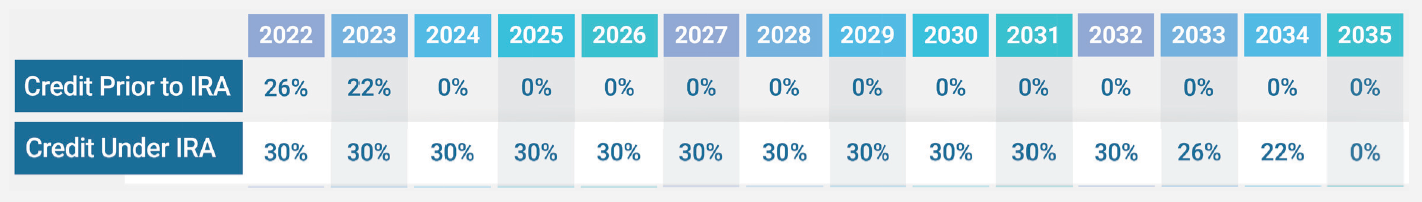

Federal tax credits include 30% of the cost of solar electric systems with no cap.

2. State Photovoltaic Incentives

State tax credits include 35% of the total cost or $5,000, per system, whichever is less. No expiration date, but credit may be reduced if part of the system is used because of the solar water heating requirement for new residential construction. In addition, production credits (called feed-in tariffs) are given at 21.8 cents per kilowatt-hour fed back into the system (for systems less than 20kW in size).

Solar Hot Water Incentives

1. Federal Solar Hot Water Incentives

Federal tax credits include 30% of the cost of solar hot water systems with no cap (same Federal tax credit for PV systems applies).

2. State Solar Hot Water Incentives

The state of Hawaii offers a personal tax credit of 35% of the cost of the system or $2,250, whichever is less, as well as a one-time $1,000* rebate for existing homes (not available for homes built after 2009).

*HEEP is a state-run program and these rebates can change at any time.

3. Local Solar Hot Water Incentives

Honolulu Solar Roofs Initiative

Low interest loans are available for income-qualified homeowners on Oahu for the installation of solar hot water systems.

Maui Solar Roofs Initiative

Zero interest loans available.

Solar Attic Fans Incentives

1. Federal Solar Attic Fans Incentives

The same federal tax credit that applies to solar PV and solar hot water systems applies to solar attic fans - 30% of the cost of the system with no cap.

2. State Solar Attic Fan Incentives

The same personal tax credit of 35% of the actual cost of the system or $2,250, whichever is less, applies to solar attic fans in Hawaii as well as solar hot water.

3. Local Solar Attic Fan Incentives

The state of Hawaii also offers at $50-75* rebate for solar attic fans via local utility companies .

*HEEP is a state-run program and these rebates can change at any time.

Background

Since originally enacted in 1976, the Hawaii Energy Tax Credits have been amended several times. As a result of SB 855 in 2003, the tax credits were revised and extended to the end of 2007. SB 3162 of 2004, allowed for a credit that exceeds the taxpayer's income tax liability to be carried forward to subsequent years until exhausted. HB 2957, enacted in June 2006, removed the credit's sunset date, increased the maximum credit for some applications, and eliminated the provision that required new federal tax credits to be deducted from the actual cost before calculating the state tax credit.

SB 644 discontinued the personal tax credit for solar water heating installations on new home construction after December 31, 2009. This legislation also disallowed residential home developers to take the tax credit for solar water heating installations in 2009.

* The Hawaii Department of Taxation issued guidance on May 3, 2010. This guidance clarified the definition of a "system," especially with respect to the use of micro-inverters. The Department of Taxation emphasized in new guidance that the number of inverters does not determine the number of systems; rather, the number of connections to the electrical system determines the number of systems.

Sources:

http://bit.ly/eia-gov-electricity-industry-report http://bit.ly/impacts-solar-investment-tax-credit-extension http://bit.ly/eia-gov-electricity-cost-by-state http://bit.ly/star-advertiser-october-electric-bills http://bit.ly/honolulu-gov-homeowner-loans

Take control of your energy usage and savings with PV Storage Solutions from AEI. PV Storage Solutions are a combination of home battery technology and PV solar panels that allow you to capture excess power, store it onsite, and have it delivered when you need it, without exporting to the grid.